Inflation 10.1% in January 2023

What measures is your business taking to mitigate?

Background to UK inflation

Inflation refers to the rate at which prices of goods and services increase over time. In the UK, inflation is typically measured by the Consumer Price Index (CPI) which tracks the price of a basket of goods and services that the average household purchases. The Office for National Statistics (ONS) keeps track of the prices of hundreds of everyday items in an imaginary "basket of goods". The basket is constantly updated and tinned beans and sports bras were added last year.

How is the UK's inflation rate measured?

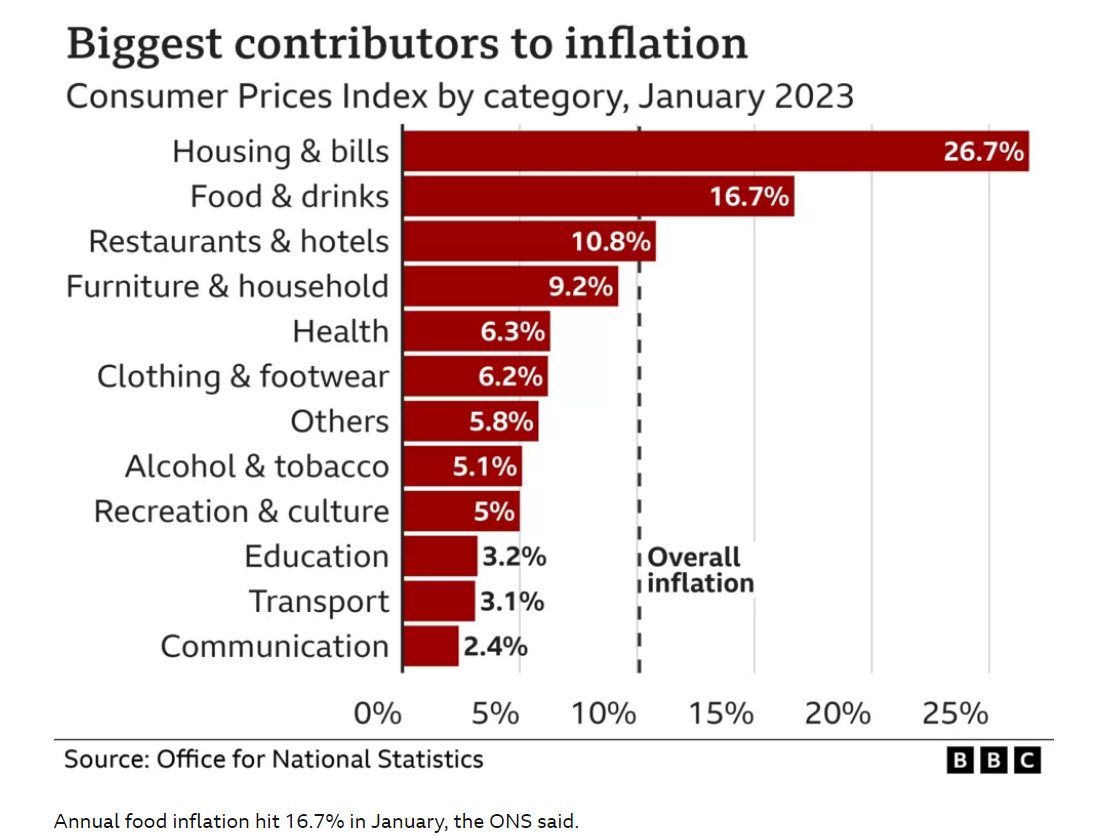

The Bank of England, the UK's central bank, has a target of keeping inflation at 2% over the medium term. Each month's inflation figure shows how much these prices have risen since the same date last year. You can calculate inflation in various ways, but the main measure is the Consumer Prices Index (CPI). Historically, the UK has experienced periods of high and low inflation. In the 1970s and early 1980s, inflation in the UK was high, with annual rates sometimes exceeding 20%. This period of high inflation was largely driven by the oil shocks of the 1970s, which led to a sharp increase in oil prices and higher production costs for many goods and services. In the 1990s and early 2000s, inflation in the UK was relatively low, with annual rates typically hovering around 2-3%. This was a period of economic stability in the UK, with low unemployment and sustained economic growth. The latest figure for CPI was 10.1% in January, down from 10.5% in December 2022. Basics such as milk, olive oil, cheese and eggs saw the largest increases but costs for sugar, jam, honey, syrups, chocolate and soft drinks and juices also jumped.

What is the impact on businesses from inflation

The impact of inflation on businesses can vary depending on a number of factors, such as the industry they operate in, the size of the business, and the extent to which they can pass on higher costs to consumers.

Here are some ways in which inflation can impact businesses:

1. Increased costs: When inflation occurs, the cost of raw materials, labour, and other inputs used in production can increase. This leads to higher production costs for businesses, which can eat into their profit margins.

2. Reduced purchasing power: If inflation is accompanied by a decrease in the purchasing power of consumers, businesses may see a decrease in demand for their products or services. Consumers will be less likely to spend money on non-essential items if their money is worth less due to inflation.

3. Pressure to raise prices: Inflation can create pressure on businesses to raise their prices in order to maintain profit margins. However, this can be challenging if consumers are not willing to pay higher prices.

4. Impact on borrowing costs: Inflation has lead to higher interest rates resulting in higher borrowing costs, likely to impact on cashflow for businesses to invest in growth or new projects.

5. Impact on international trade: Inflation can affect exchange rates, which can impact businesses involved in international trade. If the value of the local currency decreases, it can make exports more competitive but imports more expensive.

Overall, the impact of inflation on businesses can be complex and depend on a range of factors. Businesses that are able to adapt quickly to changing economic conditions and manage their costs effectively may be better able to weather periods of inflation.

When will inflation come down?

Lower inflation means prices stop rising as quickly and does not mean prices will fall (deflation). The Bank of England thinks inflation peaked last year, and expects it to keep slowing in 2023, falling to around 4% by the end of the year. The Office of Budget Responsibility (OBR), which assesses the government's economic plans, predicts that inflation will fall to 3.75% by the final quarter of 2023 - well below half the current level. Prime Minister Rishi Sunak said halving inflation by the end of 2023 is one of the government's five key pledges. But it is not clear whether he will announce new policies to achieve this, or is just relying on previous interventions.

Measures to protect a business from inflation

There are several measures that businesses can take to protect themselves from the negative effects of inflation:

1. Monitor costs: One of the most important steps businesses can take is to closely monitor their costs. By tracking expenses such as raw materials, labour, and overheads, businesses can identify areas where they may be able to reduce costs or find more efficient ways of operating.

2. Manage inventory levels: Inflation can lead to higher costs for inventory, so businesses should be careful not to overstock on goods. By managing inventory levels effectively, businesses can reduce the amount of capital tied up in inventory and minimize the impact of inflation on their cashflow.

3. Price adjustments: Businesses may need to adjust their prices in response to inflation. This can be challenging, as businesses need to balance the need to maintain profitability with the risk of losing customers if prices become too high. However, if done correctly, price adjustments can help businesses maintain margins and offset the impact of inflation.

4. Diversify suppliers: Inflation can lead to price increases for goods and services from certain suppliers. By diversifying their supplier base, businesses can reduce their reliance on any one supplier and minimize the risk of price increases affecting their supply chain.

5. Invest in technology: Investing in technology can help businesses increase efficiency, reduce costs, and remain competitive in the face of inflation. For example, businesses may be able to automate certain processes or use data analytics to optimize their operations and improve decision-making.

6. Consider hedging strategies: Businesses may be able to hedge against inflation by using financial instruments such as inflation-linked bonds or futures contracts. These instruments can help protect against the negative effects of inflation on cash flows and profitability.

Overall, businesses that take a proactive approach to managing inflation risk and focus on improving their operations and cost structure can be better positioned to weather periods of inflation.